The Banker Super-Cycle Behind the Rise of Bitcoin, Inflation, and the Great Reset

Billionaire-hedge fund manager, Ray Dalio, explains how COVID-19 and the culmination of the long-term debt cycle are generating authoritarianism, populism, and global unrest.

Ray Dalio is an American billionaire investor and hedge fund manager who founded the world’s largest hedge fund, Bridgewater Associates. As of March 2021, it had approximately US $140 billion in assets under management.

In Ray Dalio’s perspective, the world is at the late stages of what he calls the long-term debt cycle. A time period characterized by high-debt levels, near-zero interest rates, and extreme money printing. These long-term debt cycles come around approximately once every 50-100 years with this current cycle beginning in 1944 when the world entered the US dollar-denominated Bretton Wood’s financial system. Because this long-term debt cycle comes along about once every 50–100 years, most people live their entire lives without experiencing the conclusion of one. As a result, they typically take people by surprise, which financially hurts a lot of people.

In contrast, short-term debt cycles last about 5-10 years. These are more commonly known as the “boom-and-bust cycle” or “business cycle”. During these short-term debt cycles, debt accumulates until a recession occurs, which causes a deleveraging period where stock and other asset prices fall, and then upon recovery, debt starts to accumulate again. However, these deleveraging periods rarely bring debt as a percentage of GDP back down to where it was at the beginning of the cycle, so each subsequent short-term debt cycle starts with a higher level of debt than the previous cycle. In other words, the long-term debt cycle is made up of the debt accumulation over numerous short-term debt cycles.

During recessions, central banks typically respond by cutting interest rates, which stimulates the economy by encouraging more borrowing and reducing the relative debt cost. This process of debt accumulation and lowering interest rates repeats itself for decades. When interest rates hit the floor at 0% marks the beginning of the end of the long-term debt cycle and the start of a deleveraging period where central bankers begin to devalue their currencies. Interest rates can no longer be lowered because they are at zero. Therefore, policy makers only have two remaining options; quantitative easing (i.e., printing money and buying financial assets) or printing money and putting it directly into the hands of people in the form of stimulus payments. In the words of Ray Dalio:

“When the risk-free interest rate that they control hits 0% in a big debt crisis, central banks lowering interest rates doesn’t work. That drives them to print money and buy financial assets. That happened in 1929-33 and 2008-09. We call the power of central banks to stimulate money and credit growth in these ways “the amount of fuel in the tank.” Right now, the world’s major central banks have the least fuel in their tanks since the late 1930s so are now in the later stages of the long-term debt cycle.”

Think of the long-term debt cycle as the dynamic between interest rates, debt, and money printing. For example, both the 2008-2009 Global Financial Crisis and the 1929-1933 Great Depression coincide with interest rates hitting the 0% floor. In response to both, the Federal Reserve printed money, devalued the dollar, and bought financial assets. When interest rates hit zero, central bankers can no longer lower interest rates, and therefore, they print money sacrificing the value of their currencies in order to stimulate markets.

The Great Depression was the culmination of a previous long-term debt cycle in which debt continued to accumulate until interest rates hit the 0% floor. The US debt-to-GDP ratio grew steadily for five decades between the 1880s to 1930s. In a similar fashion, the debt-to-GDP ratio steadily grew from the 1980s leading up to the 2008 Global Financial Crisis. This process of debt accumulation leading into the Great Depression and the Global Financial Crisis can be seen in the chart below:

After the Great Depression, during the period of currency devaluation, non-federal debt decreased while the federal debt-to-GDP ratio climbed from 39% to 123% culminating in World War II. In a similar fashion, following the 2008 Financial Crisis, non-federal debt decreased while the federal debt-to-GDP ratio climbed from 65% to 135% culminating in COVID-19. The response to COVID-19 pushed the federal debt-to-GDP ratio to a new historic high above the peak last seen during World War II.

At the end of the long-term debt cycle, there is also a corresponding growing wealth and income gap. This is due to the fact that while these monetary policies increase the price of financial assets, incomes typically do not keep up, and therefore, those not invested in financial assets only experience the increasing cost of inflation. As people lose their wealth and opportunity, they lose faith in their establishments and institutions. Populism rises. In other words, a rebellion of the "common man" against the "elite establishment". Disenfranchised by the system, voters have increasingly voted for anti-establishment movements such as Donald Trump, Jair Bolsonaro, and Brexit. Historically, periods of large wealth gaps are often marked by internal conflict and social unrest often culminating in either taxes, revolutions, or wars.

The World Economic Forum (WEF) is an “international organization for public-private cooperation” that counts the world’s richest elite among its members. At the start of the COVID-19 lockdowns, WEF Founder Klaus Schwab announced “The Great Reset”, which would involve the coordinated transition to a Fourth Industrial Revolution global economy in which human workers become increasingly irrelevant. As it is envisaged, it seems to be a total corporate takeover of all aspects of life. Using a technocratic biosecurity state apparatus to implement the changes, will mean a social credit system, a loss of bodily autonomy, and extensive restrictions on work, school, and travel. In sum, “The Great Reset” is how WEF-technocrats intend to use the response to COVID-19 at the end of the long-term debt cycle to modify human behavior into their authoritarian vision.

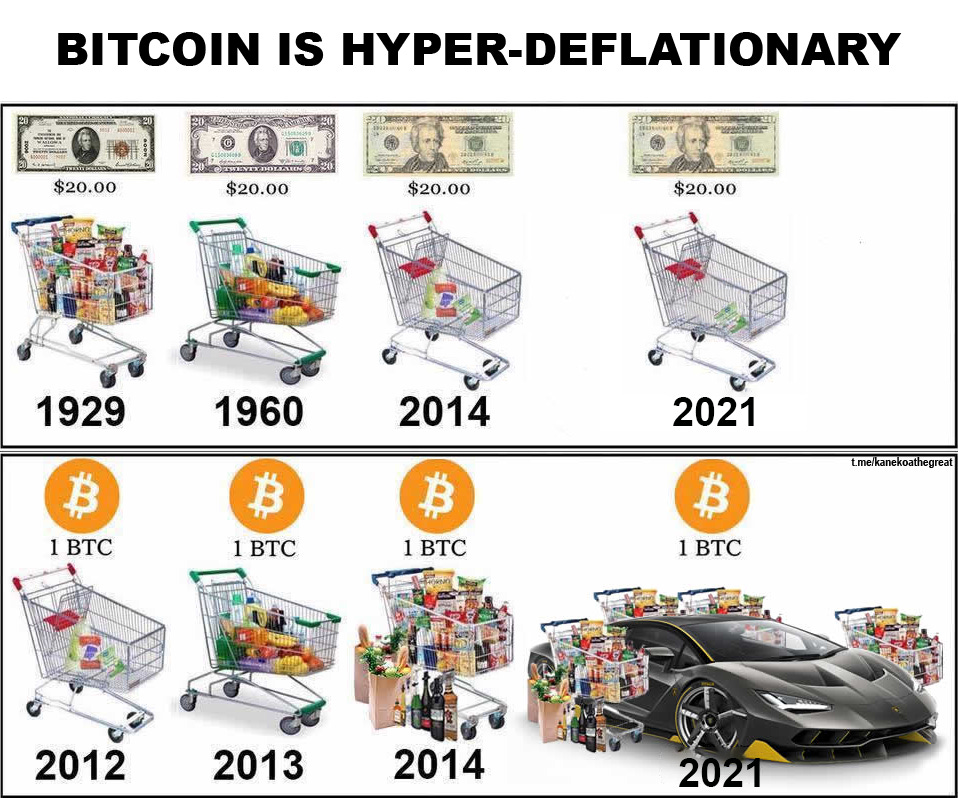

In contrast, Bitcoin is a decentralized, open-source, and permission-less financial system that removes third-party intermediaries including central bankers. For example, someone sent $1 billion in Bitcoin this week and paid only $1.75 in transaction fees. Instead, of waiting on a bank or asking permission from a third party, they logged onto the internet and sent Bitcoin from their wallet to another wallet. Over the last decade, Bitcoin has gone from nine pages on a white paper to the world’s largest tech companies and central bankers attempting to create their own centralized versions of it. Much of this success is due to the fact that Bitcoin is hyper-deflationary in an increasingly inflationary world. This is why the programmer operating under the pseudonym of Satoshi Nakamoto wrote “Chancellor on brink of second bailout for banks” on the first Bitcoin block mined in January 2009. At the end of the long-term debt cycle, while central bankers print money and devalue their currencies, Bitcoin’s supply will remain hard-capped at 21,000,000.

To summarize, the world stands at the crossroad at the end of the long-term debt cycle. Authoritarians are using COVID-19 to establish technological and biosecurity frameworks for increased top-down control. This is being accomplished by using the false guise of vaccine passports to compel citizens to cooperate in establishing a social credit system. Lockdown policies have erased upward mobility for a large segment of the population. The United Nations says that global lockdown policies pushed over 150 million people into starvation representing a 15-year trend reversal in world hunger. While corporate media and social media have moved in unison to control the conversation with operations such as the Trusted News Initiative. Authoritarians are tightening the leash on humanity by silencing and censoring anyone who speaks up against the central narrative.

The idea of using a pandemic to impose tighter top-down control, modeled after the Chinese social credit system, was first described in a 2010 Rockefeller Foundation report (the so-called ‘lock step’ scenario). In 2017, Dr. Seth Berkley, CEO of Gavi, wrote a piece for Nature that emphasized the pressing need to move to digital vaccine IDs. Bill Gates announced digital vaccine passports during a March 2020 TED Talk interview, “Eventually, what we’ll have to have is certificates of who’s a recovered person, who’s a vaccinated person… so eventually there will be this digital immunity proof that will help facilitate the global reopening up.” Vaccine passports are a key component of the biometric ID2020 project run by the Digital Identity Alliance, which was founded by Bill Gates – via Microsoft and GAVI – and the Rockefeller Foundation, which is itself linked to the Known Traveler program initiated by the World Economic Forum. In 2018, the ID2020 project wrote an article entitled, "Immunization: an entry point for digital identity,” where the authors emphasized how vaccine passports will be part of a “secure digital identity” enabling access to a “wider range of social services” such as “school or financial services”. The response to COVID-19 appears to have served not only its publicly stated purpose but also the global elites’ ulterior motives.

You can find me on telegram, rumble, and gab.

THE UPDATE:

Why Decentralized Technology Matters for Freedom: Alex Gladstein, chief strategy officer of the Human Rights Foundation, explains how oppressive regimes intend to remove financial privacy. With electronic payment systems taking over and Central Bank Digital Currencies looming, decentralized currencies like Bitcoin will become increasingly important. The government wants to surveil all of your financial data, while banks and online payment services are increasingly cutting off access to those with differing opinions. Watch.

Supply Chain Problems, Worker Shortages, And Inflation Pressure: Economist John Maulden on the intensifying supply chain problems raising costs in ways that add broad inflation pressure everyone will feel. COVID has introduced pressures into life that weren’t there before. Throw in the political divide of mandates versus non-mandates, the politicization of the virus, the mis- and disinformation about vaccines and the virus, and you have a witch’s brew of reluctant workers. Read more.

Trump Set To Gain Billions In Net Worth On Moonshot SPAC: Former President Donald Trump's new media enterprise - Trump Media & Technology Group - is already worth an implied $8.2 billion following last week's buying frenzy. Owners of the SPAC will receive around 42% of the combined company, leaving 58% for Trump - a stake worth nearly $4.8 billion based on Friday's close. For reference, Twitter is worth nearly $50 billion. Read more.

The CDC Is Lying To The World About COVID-19 Vaccine Safety: Steve Kirsch, Founder of the COVID-19 Early Treatment Fund, provides analysis on the CDC VAERS data. Mr. Kirsch cites a CDC paper published in 2020 that states serious adverse events in the past have been under-reported by at most a factor of 8.3 then goes on to show that numerous adverse advents are being reported at a rate that is more than 8.3x higher than previous years. Read more.

A lot to take in. In typical KanekoaTheGreat fashion, you laid it out clearly, made it understandable, and included relevant graphics. I can see the advantages of Bitcoin. I still don’t feel I understand it well. I did understand there is a hard cap. So that must be what drives the value bus so to speak. I have questions about what distinguishes Bitcoin from other cryptos, and how it stacks up against the classic hedge of gold and silver. I see you left some links which I will explore.

Keep writing great stuff for us. Appreciate you work!!!

Mahalo 🙏🏽❤️🌺

And why is Mike Pompeo shrinking so quickly???😳

I always loved checking you stuff on telegram and forwarded much of it. If you check out my telegram channel of second, and go towards the top of it. You'll see 7 videos of the constitution. Wow, that, along with many things I see and people I follow, I made a stand. Today I asserted my God given rights. Anyway, share if you have the time bro. God bless you and thanks for all you do. https://t.me/GwapoJoePublic